Lifetime events modeler

The lifetime events modeler is similar to the cash flow scenarios or what-if's

(

Article 410), although it is aimed at the lifetime planner, and so has more events

at it's disposal, and it is focussed on a longer term view.

Because of this focus, scenarios are mapped against the 'bottom line', which is the lifetime

savings forecast from the lifetime planner. These are much more long term events that those in the cash flow (although they can affect cash flow now)

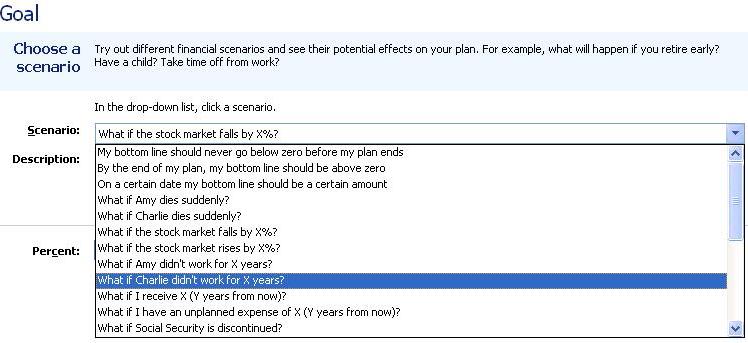

The types of event modelled depend on information within the planner. However, these include such scenarios as the death of a person in the planner,

changes in stock markets, tax changes, or change in dependents. In addition, you can put in scenarios that you want to avoid - such as the bottom line going below

zero before the end of the plan. Some options will not be listed - for example if you have no partner listed, then you would not see the additional person selections.

The options screenshot can be seen below - as you can see, there are a number listed (click on it to view a larger image)

Each scenario allows you to enter additional information, if it is required, such as percentages, amounts, time etc. Those scenarios which try to

avoid

a situation allow you to change a lifetime event parameter (such as a retirement age).

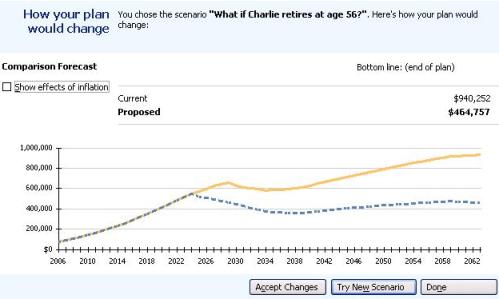

In the image above, a scenario has been chosen where Charlie retires 5 years earlier. You can see the potential impact on the bottom line

from the resulting chart.

Note: This feature of the program should be used as an illustration only - it makes assumptions based on the

information you have put into the program, and so you can't guarantee the numbers are going to be exactly correct. It is a useful illustration.